Veterinarian Practice Insights: 2021 in Review

Posted on January 12, 2022

Overview of the M&A Market for Veterinary Practices

2021 was an incredibly busy year for veterinary practice acquisitions. Many practice owners, anticipating tax changes, entered the market to sell their practice. A hungry group of consolidators eagerly pursued these opportunities. Although the “end of year” 2021 rush may temporarily slow activity, there remains a strong desire for acquiring well-performing practices in 2022. We hear from some consolidators that the pipeline of new opportunities is already beginning to replenish as sellers seek to take advantage of a very liquid and active M&A environment.

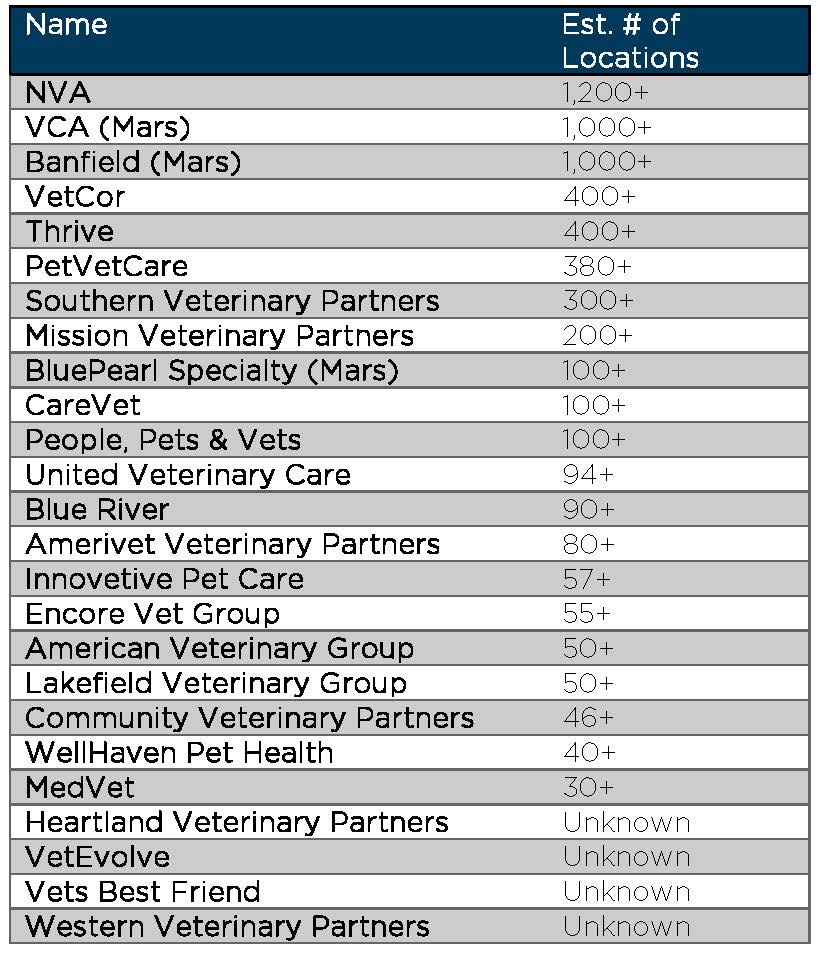

Consolidation will continue to tip the balance between individually owned practices and corporate controlled clinics. We estimate that in excess of 5,700 locations are now corporate controlled. Of those, nearly 60% are operated by a Mars Corporation or NVA. Despite this consolidator concentration, there are a number of other hungry groups that are seeking new acquisition opportunities. Many of these have the backing of private equity funds and are eager to find strategic targets. Each of these smaller consolidators have unique structures and as such, offers originated by each group for new acquisitions are unique in terms of consideration (i.e. cash, earnout, note) and valuation approach. We anticipate that many of these smaller practice groups will become ideal targets for some of the larger corporate consolidators as they gain scale.

Larger Veterinary Practice Transactions

There were a number of large /notable transactions that occurred in the industry during 2021. Some of the most notable were the following:

Current Veterinary Practice M&A Market Conditions

The market for well-run independent general practice and specialty practice clinics remains robust. Buyers continue to look for ways to grow, including acquisitions. Acquisition multiples vary, but for strong clinics, multiples offered remain at elevated levels. While there are a number of factors that drive successful transactions, one of the most important remains the retention of associated DVMs and other key employees. In today’s challenging labor environment, this has become an even more important aspect of a completed closing.

In addition to the operating clinics, the market for real estate occupied by veterinary practices continues to be desirable. Entities such as Terravet, Hound Properties and Vetley Capital have shown interest in purchasing real estate occupied by Veterinarians.

Key Items to Consider When Selling Your Veterinary Practice

When thinking about selling your practice, there are a handful of items to think through, including:

- Review key employee /associate DVM agreements;

- Evaluate condition and adequacy of diagnostic equipment – is it in good working order or is there deferred maintenance outstanding?;

- Review your practice financials and identify potential extraordinary / non-recurring income and expense items;

- If real estate is owned, consider your appetite for retaining real estate ownership.

If the practice location is leased, what is the remaining length of time

on the lease?; - Collect and understand outstanding financing, diagnostic lab and other key vendor agreements; and

- Select an advisor that knows the industry, can prepare a valuation range and knows what information is relevant to present to potential buyers